Alcohol alternatives are packing a punch and audience intelligence platform Pulsar has shone an intriguing light on three trends driving the change.

“Here’s to alcohol, the rose-colored glasses of life.” – F. Scott Fitzgerald, American novelist.

Alcohol is deeply embedded within the culture of Western societies, with bottles, glasses, tumblers and flutes staples of almost any social occasion.

The winds of change are blowing, however.

Demand for low and no alcohol beverages is on the rise, encouraging drinks manufacturers to innovate. It was forecast that the non-alcoholic beer market alone would enjoy 10.3% growth by the end of 2021.

It is therefore not surprising, in our digitally-dominated era, to witness social conversations increasingly centred on the newer alternatives. In addition, Pulsar has also mapped a concurrent rise in search volume online around “Non-Alcoholic” and “Low Alcohol” mentions on Twitter since the last four years.

The low-no alcoholic drinks landscape in 2021 was clearly defined by three trends that have emerged on social platforms:

- The impact a younger generation of consumers are creating

- The continued importance of heritage brands

- The varied and separate needs of different communities

The generational effect

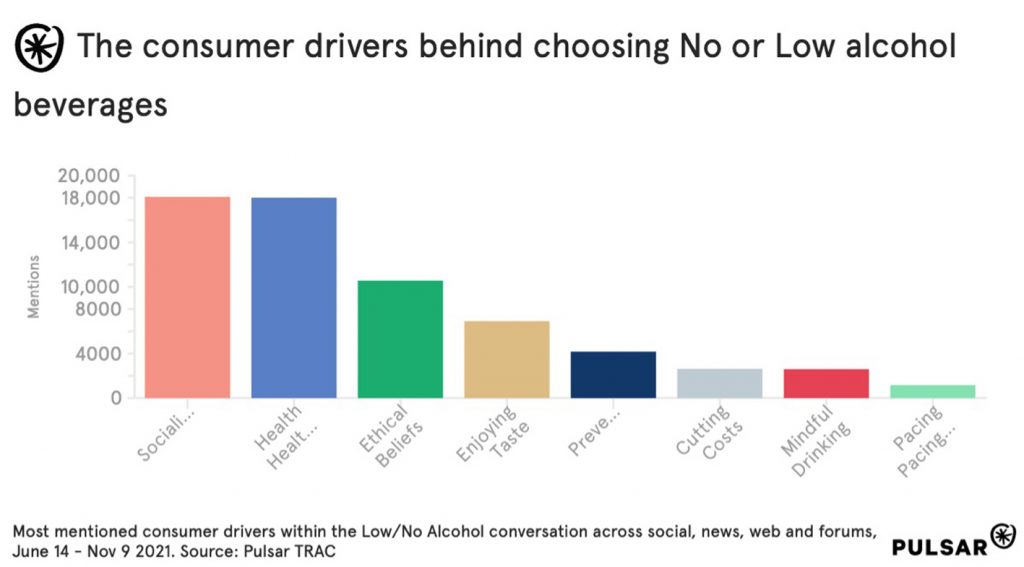

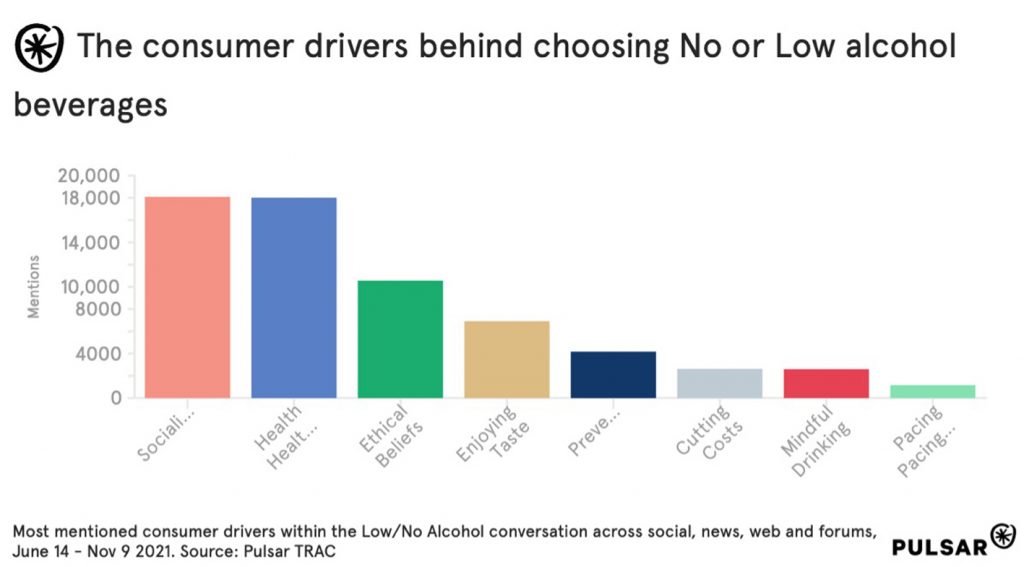

There are various reasons behind people’s decisions to abstain from alcoholic beverages. Some stay away due to ethical and religious beliefs; others cite medical grounds as to why they prefer the low and no alcohol alternatives.

But more and more consumers are choosing to take a break from alcohol. 6.5 million people – an increase of 2.6m – participated in Dry January 2021 in the UK.

Younger generations are driving this change. Mindful drinking and ‘pacing’ are seen as arguments that would not have gained purchase in previous generations.

Alcohol is predominantly consumed when socialising. Consumers want to be able to continue with their usual routines, without needing to alter their behaviour. They also want the reassurance that their choice of beverage does not carry health risks. Recent data drawn using audience intelligence platform Pulsar confirms this, with socialising named the main driver for low or no alcohol’s consumption, alongside health consciousness.

A prominent challenge facing manufacturers of low and no alcohol drinks is penetrating the space previously dominated by traditional alcohol.

Harrogate Spring Water is a prime example of how brands can use creativity to navigate this obstacle. Collaborating with Camille Vidal – the founder of La Maison Wellness – they have developed the ‘Mindful Drinking’ competition. This looks to give aspiring bartenders a platform to share innovative recipes that focus on having no alcohol content.

The heritage manufacturers

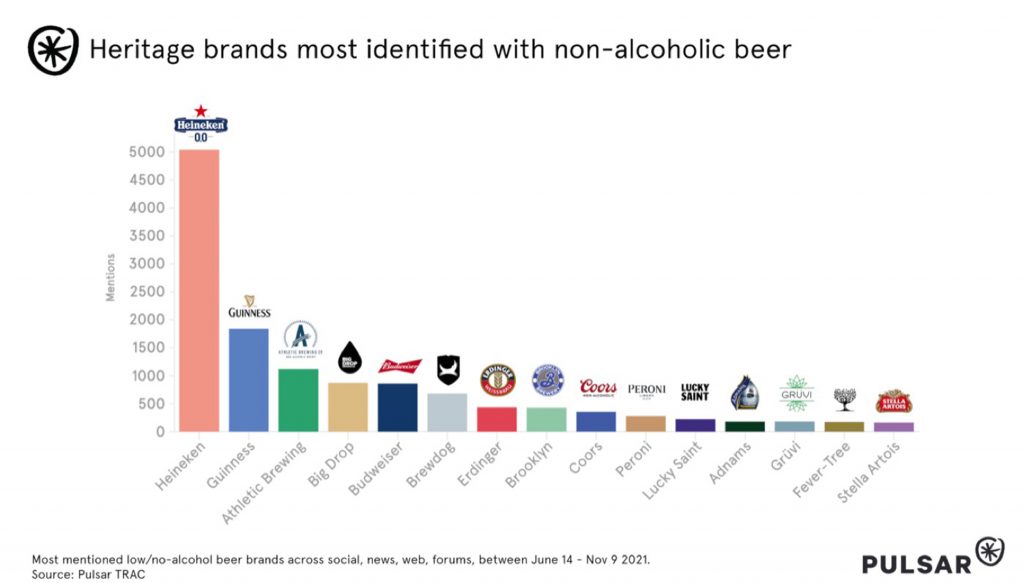

A number of heritage brands are attempting to recreate their popularity in the no and low alcohol space. According to data from Pulsar, beer remains the frontrunner in this department. However, this partially stems from a lack of awareness for the alternatives.

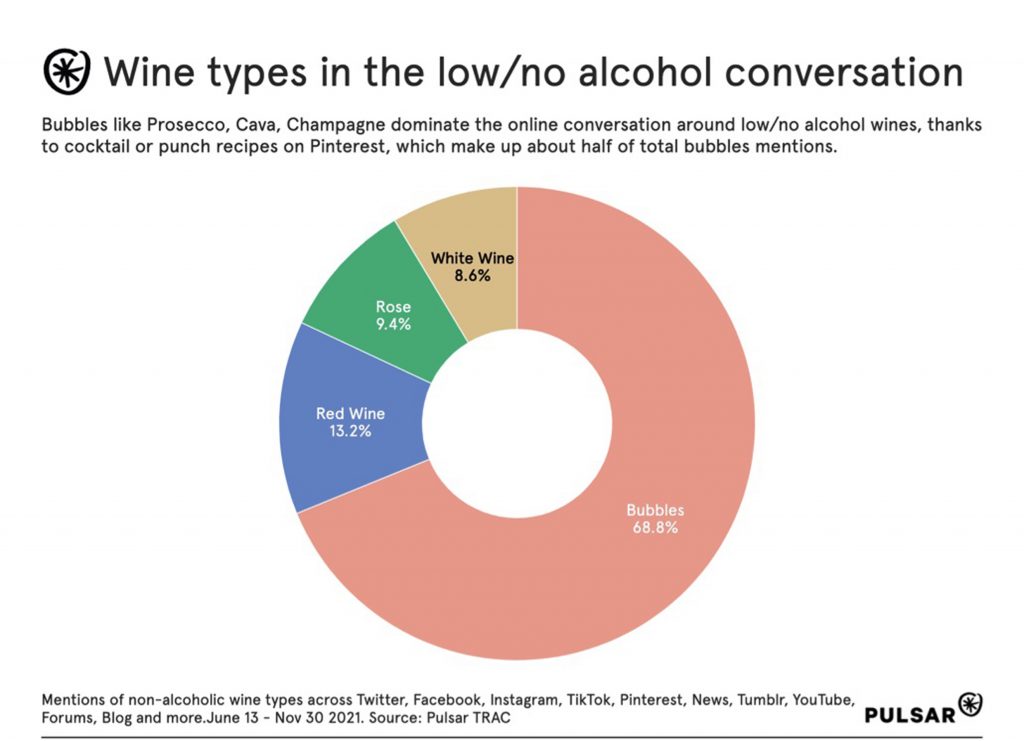

2021 saw the tides start to turn. If the digital mentions for punch and cocktails were combined, they would eclipse the mentions of beer. This highlights the fact that homemade variants are gaining greater interest.

This is in large part due to people crafting their own recipes at home, and becoming more inclined to share recipes during the pandemic.

Homemade low-no beverages have even contributed to the rise in popularity of low-no “bubbly” wine; data from Pulsar shows bubbly wine is the most popular drink in the wine category, and is particularly appreciated for its likeliness to mix easily into punches and cocktails.

The additional free time has led consequently to greater experimentation, with visual content platforms helping to accelerate the trend.

Pulsar’s data showcases that Heineken dominates the no and low alcohol beer social mentions. The sponsorship agreement they forged with Euro 2020 played a large part in this – alongside the longstanding relationship it has with the James Bond franchise.

Drinks brands that track social data such as this can develop a greater understanding of their audiences. Following certain trends can help to better inform strategy, and the creation of marketing campaigns.

The community factor

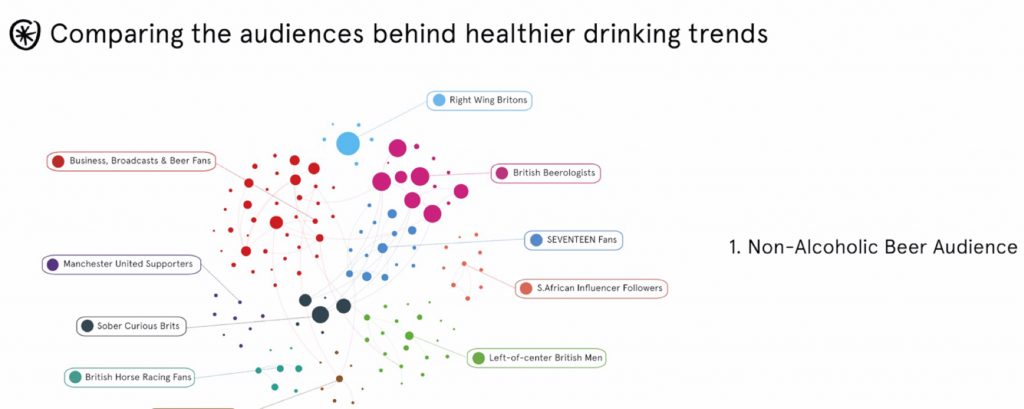

A number of communities can be found within the alcohol sector, each with their own beverage preferences.

Beer, hard seltzers and spirits have proven themselves to be most popular amongst consumers. It is in these areas that manufacturers must look to diversify, and try to offer no and low alcohol alternatives.

There is no ‘one size fits all’ within the demand for alcohol free drinks.

Communities with links to traditional UK sporting institutions -although these communities themselves can be international in nature – have a particular affinity for non and low alcohol beer. Professional horse racing, as well as other sporting institutions such as Manchester United, are prime examples of institutions linked with both the imbibing and promotion of non-alcoholic beer.

K-pop has also led to alcohol alternatives becoming a mainstream topic of conversation amongst younger audiences, thanks mostly to the boy band, SEVENTEEN, and their song ‘Alcohol Free’. This instance does not always equate to consumption, of course, but does serve a role in popularising and normalising the drink type.

Low and no alcohol drinks have not had an easy journey – for years, they have been the butt of jokes, particularly on social platforms. But consumer tastes are evolving. And so heritage manufacturers, not wanting to become a relic of the past, are changing their strategies.

Fitzgerald’s opinion of alcohol is not one that holds much store with the youth of today. Low alcohol is here to stay. The perception of these brands is shaped by emerging subcultures across social media. Millennials and Gen-Z are conscious of the need to look after themselves – and brands have an opportunity to capitalise on this new mindset by listening to the ongoing social media conversation surrounding alcohol alternatives.