Adrian Wood shares a ten-step strategy for evaluating, selecting, and implementing planning software that delivers long-term competitive advantage

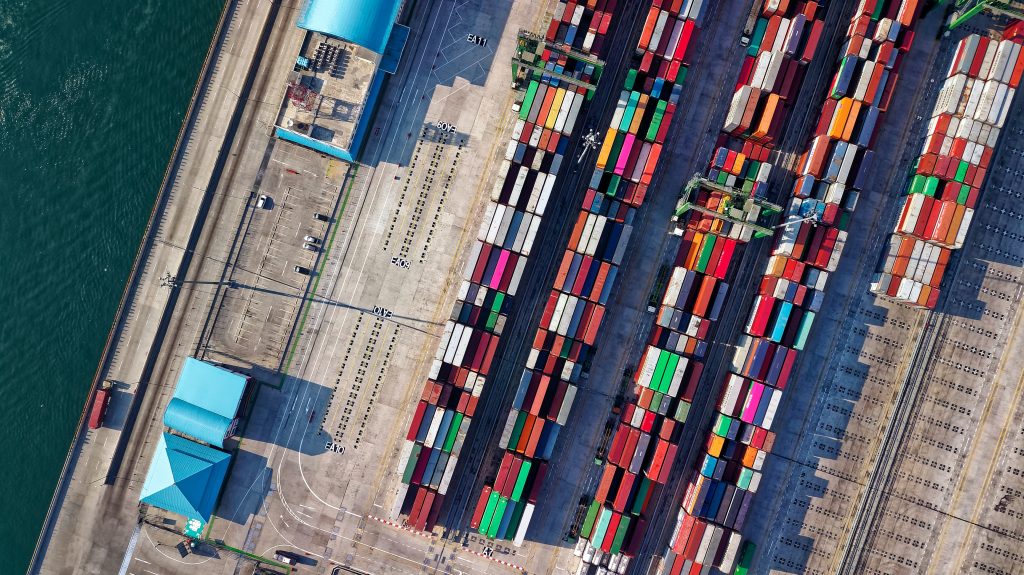

In today’s global economy, supply chain performance has become a decisive lever for margin, cash flow, and customer satisfaction. Companies with logistics-intensive operations are feeling the strain of volatile demand, shifting schedules, labour shortages, and ongoing supply volatility. For years, businesses have relied on enterprise resource planning (ERP) and supply chain management (SCM) software to guide decision-making. However, these systems often provide backward-looking insights, failing to account for unique capabilities, assets, and future possibilities. Supply Chain Planning and Optimisation (SCP&O) offers the forward-looking capabilities companies need to address these challenges and uncover new profit opportunities.

Across industries – including FMCG manufacturing and retail – SCP&O helps reduce inventory holding, improve on-time delivery, optimise resource utilisation, and build resilience. The point is not just buying software; it is establishing a decision-making discipline that turns data into confident, timely plans at every horizon: strategic, tactical, and operational.

SCP&O tools combine predictive analytics with optimisation and what-if modelling so organisations can sense change, simulate options, and select the best path forward. Done well, this closes the gap between commercial ambition and operational reality – whether the task is balancing production schedules, managing supplier capacity, or aligning distribution with demand fluctuations.

Key benefits

- Better decisions, faster: Planners can compare scenarios — such as supplier changes, production rescheduling, or new market entry – and select the best trade-off for cost, time, and risk.

- Scalability: Cloud-ready platforms scale across regions, business units, and partners without rebuilding processes from scratch.

- Resilience: Integrated planning improves visibility of constraints and creates contingency plans before disruption bites.

10 steps to choosing the right SCP&O software

1. Define goals and assemble the right team

An SCP&O investment touches most of the business, so design the process to be cross-functional from the outset. Bring together operations, planning, finance, procurement, commercial, IT, and logistics leaders. Give the team a clear mandate: agree on the outcomes the organisation values – for example, reduced lead times, lower working capital, improved service levels – and how success will be measured.

Map your business goals to measurable KPIs and the planning decisions that influence them. If the goal is to reduce delivery variance, for example, the decisions might include supplier allocation, production sequencing, or transport optimisation. Nominate an executive sponsor with the authority to remove roadblocks and a practitioner lead who will own the day-to-day evaluation.

2. Identify critical features

Translate goals into the capabilities the solution must deliver. Useful techniques include a goals-to-decisions matrix and value-stream mapping of your planning processes – demand, supply, capacity, and inventory. Prioritise features that directly impact the KPIs, not merely “nice-to-haves.”

In logistics-intensive or multi-site operations, critical features often include multi-tier visibility, constraint-based scheduling, supplier capacity transparency, substitution rules, and budget/forecast alignment. Capture the realities of your operation: regional working patterns, multilingual needs, compliance requirements, and the level of planning granularity needed across sites, products, or territories. Stress-test prospective features with simple what-if cases: “What happens if component lead times extend by two weeks?” or “How would a 10 percent demand surge affect production throughput?”

3. Conduct a financial analysis

Quantify the economics of change. Establish a baseline of current costs – materials, logistics, overtime, waste, and finance charges tied to working capital – and compare against potential post-implementation benefits. Build your model from the ground up and then roll it up to investment metrics such as ROI, IRR, and NPV. Use realistic adoption timelines and sensitivity ranges; avoid vendor-provided benefit multipliers unless you can validate them internally.

Include full lifecycle costs: licences or subscriptions, configuration, integrations, data migration, training, internal project time, change management, support, and upgrades. Consider savings that may accrue in ERP or other systems once planning moves into SCP&O (for example, streamlining workflows or reducing manual scheduling effort). Balance tangible savings (e.g. lower inventory, fewer transport miles) with strategic benefits (e.g. faster scenario evaluation, improved supplier collaboration). Document all assumptions and have finance sign them off.

4. Shortlist and assess vendors thoroughly

Research the market with your priorities in mind. Decide whether you want a specialist SCP&O partner or a broader platform provider with planning as part of a larger suite. Examine each candidate’s sector knowledge, innovation roadmap, client base, and track record. Ask to see case studies relevant to your type of operation – manufacturing, FMCG, retail, or logistics.

Create a weighted scorecard that reflects your must-haves and differentiators: modelling approach, usability, integration tools, security, configuration flexibility, performance at scale, analytics and visualisation, and total cost of ownership. Incorporate independent sources — analyst reports, peer reviews, and customer references – alongside your own evaluations.

5. Build a business case

With candidate capabilities understood, assemble a concise case for decision-makers. Link the investment directly to business outcomes: improved service reliability, reduced stock levels, faster order fulfilment, and stronger supplier relationships. Show how benefits phase in across planning horizons – short-term scheduling improvements, medium-term capacity balancing, and long-term strategic network optimisation.

Be transparent about costs and risks. Include training, internal backfill for key staff, and the effort required for process standardisation. Use one page for the executive summary – objectives, options considered, recommended approach, headline ROI and payback – and an appendix with supporting analysis. Engage sponsors early so that expectations on detail and depth align with leadership needs.

6. Evaluate solutions with demos

Turn vendor demos into working sessions. Provide suppliers with a clear brief, representative datasets, and a script that reflects realistic challenges – conflicting constraints, missing data, last-minute order changes. Ask vendors to show how planners test options, capture decisions, and communicate adjustments across departments.

Focus on usability and adaptability: can planners modify a constraint and instantly see its ripple effects? How are scenarios stored, compared, and approved? What does collaboration look like across teams and partners? Probe reporting: can you generate real-time dashboards, supplier commitments, and exception lists without exporting to spreadsheets? Record findings in the scorecard so comparisons remain objective.

7. Examine implementation capabilities

The best software can stumble without a solid implementation framework. Ask for documentation that outlines discovery, data design, modelling, iterative configuration, user validation, training, go-live, and post-launch support. Look for phased approaches that create early wins – for example, starting with demand/supply balancing for a pilot region before expanding to full-scale optimisation.

Clarify roles: who provides project management, data migration, integration development, and change management? What resources will your organisation need to commit week by week? Request indicative plans showing timelines, dependencies, and deliverables. Check the quality of training materials and confirm whether a “train-the-trainer” model is available. Ensure governance is strong enough to prevent configuration creep that undermines value.

8. Make the final choice

When evaluation is complete, weigh quantitative evidence – ROI, cost, and time-to-benefit – against qualitative factors such as cultural fit, user experience, and vendor responsiveness. Consider strategic alignment: does the vendor’s roadmap support where your business is heading, whether that’s digital manufacturing, omnichannel retail, or global logistics expansion? Treat the purchase as a long-term partnership. The most effective solution may not be the cheapest, but the one that consistently delivers performance, scalability, and adoption.

Commercially, aim for clarity and simplicity. Define scope, deliverables, and success criteria in plain language. If rolling out in phases, tie payment milestones to usable capability rather than elapsed time. Protect room for innovation by reserving a small budget for continuous improvement once the core system is live.

9. Verify vendor credentials

Before contract signature, conduct due diligence. Speak to references that resemble your organisation in scale and complexity, not just flagship clients. Ask what went well, what could have been better, and how issues were resolved. Review the vendor’s financial stability, data security credentials, and compliance record. Confirm service-level agreements, escalation paths, and support arrangements. Check how active the user community is and how often product updates are released.

10. Commit to continuous improvement

Planning excellence is an ongoing discipline, not a one-off project. Establish a cadence for reviewing KPIs, user feedback, and model accuracy. Refresh data pipelines as your systems evolve and retire manual workarounds. Expand scope in sensible stages – perhaps adding supplier collaboration portals, inventory optimisation, or network design once the core is stable. Use scenario modelling to support contingency planning and new market strategies so planning becomes the organisation’s natural reflex, not an exception.

Final thoughts

SCP&O is ultimately about confidence: confidence that today’s plan is the best available, and that tomorrow’s can adapt at speed. Organisations that approach selection methodically – with clear goals, financial discipline, and a structured implementation path – realise the strongest results. For manufacturers, retailers, and logistics providers alike, the prize is tangible: steadier operations, healthier cash positions, and more resilient supply chains ready to flex with market shifts and global uncertainty.

Adrian Wood is the Strategic Business Development & Offer Marketing Director, at DELMIA